Exemption of Capital Gain under Section 54B I Save tax on sale of Agricultural Land #capitalgain - YouTube

USDA ERS - ERS Modeling Shows Most Farm Estates Would Have No Change in Capital Gains Tax Liability Under Proposed Changes

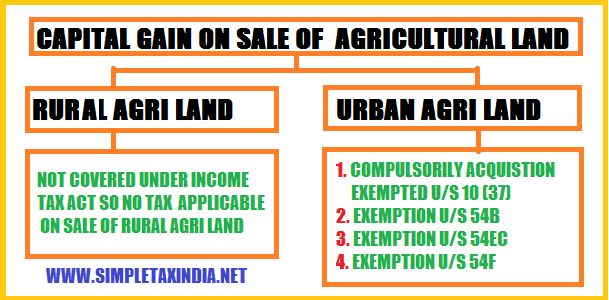

Buy Capital Gain on Sale of Agricultural land and tax planning for Agricltural Income Book Online at Low Prices in India | Capital Gain on Sale of Agricultural land and tax planning

Consideration from sale of urban agricultural land is subject to capital gains tax: ITAT upholds revision proceedings u/s 263 of Income Tax Act