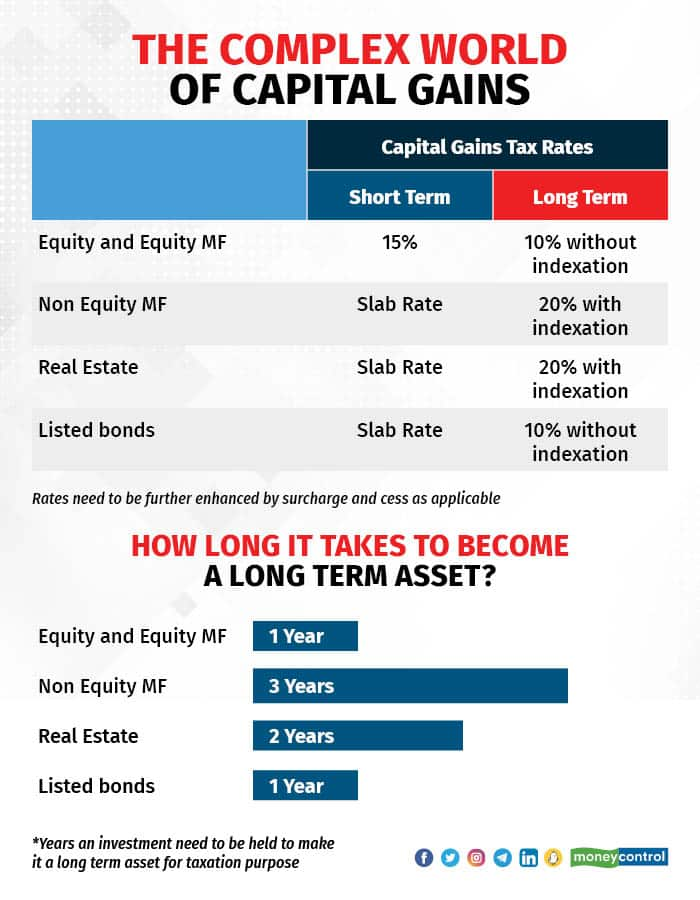

Budget 2023 Expectations: Shorter holding period for non-equity funds, hike in equity LTCG limit to Rs 2 lakh

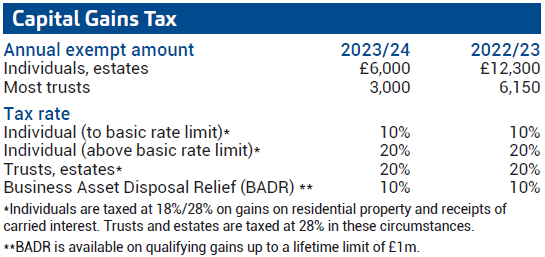

capital gain tax: Investment limit capped at Rs 10 crore for capital gains account scheme from FY2023-24 - The Economic Times

luxury property deals: Capital gains deduction limit of Rs 10 crore to hurt luxury property deals - The Economic Times

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)